Hey there!

We know that VAT registration might be a real headache, so we’ve prepared this guide to help you navigate the intricacies of the process. In this Article, we’ll explain what VAT is, the registration requirements, including the list of documents needed, types of registration, the step-by-step process, and common mistakes to avoid. If, after reading it, you realize that you need our help, don’t hesitate — VAT registration services are included in our core scope. Let’s go!

What is a Value Added Tax?

Value Added Tax is a general sales tax applied to most goods and services in the UAE at each stage of the supply chain, with certain exemptions and zero-rated categories. It was introduced in the UAE on 1st January 2018 at a standard rate of 5% with the Federal Tax Authority (FTA) being responsible for the regulation and collection of VAT in the UAE. Businesses charge VAT on their sales (output tax) and can usually reclaim VAT paid on eligible business purchases (input tax).

Your obligation to register is linked to annual turnover — the value of your taxable supplies and imports over the past 12 months. Once you cross the relevant threshold, you must register, obtain a tax number, and start charging, recording, and filing VAT.

An important nuance to note is that if you paid input VAT on your purchase while unregistered, you can still recover it after registering. Purchases of services can be claimed within a 5-year period from the purchase date, while goods can be claimed for their unused portion – for example, for capital assets, this would be the non-depreciated portion.

VAT registration requirements

Mandatory vs Voluntary

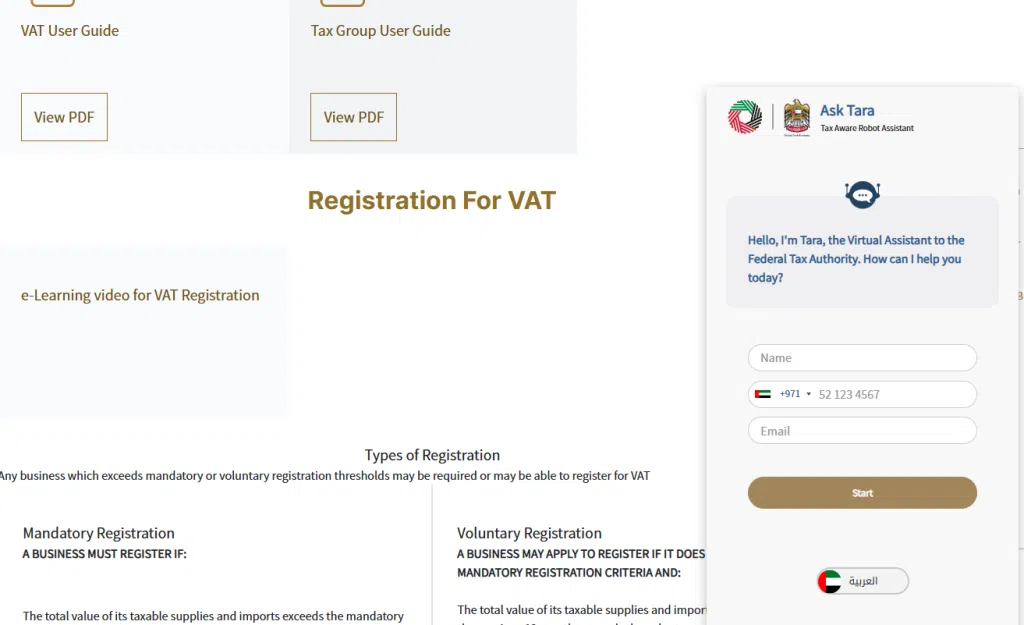

There are two types of VAT registrations: mandatory and voluntary. Let’s find out the difference between them.

Mandatory registration is required for your company if annual turnover exceeds AED 375,000 or is expected to surpass this level within the next 30 days, whichever occurs first. You can predict threshold surpasses based on signed contracts, scheduled deliveries, or pro forma invoices.

If you do not meet the mandatory threshold, you can opt for voluntary registration — but only in case your annual turnover exceeds AED 187,500 over the past 12 months, or is expected to do so in the next 30 days.

There is a benefit to registering for VAT voluntarily, which is the ability to claim input VAT early. Additionally, in the case of imports, this allows for the use of the reverse charge mechanism (RCM), which is cash-neutral, instead of paying cash VAT at the border.

If your company’s turnover is below AED 187,500, you do not need to register for VAT yet.

How to calculate your annual turnover?

To check whether your business has reached the VAT registration threshold, you need to calculate your annual turnover. In the UAE, turnover includes all taxable supplies and imports (taxable expenses) made during the past 12 months. When calculating it, follow the rule of the earliest event — your turnover is recognized based on whichever happens first:

- The invoice is issued

- The payment is received

- The goods or services are delivered

For example: completed the service on March 5, issued an invoice on March 10, and received payment on March 15. For VAT purposes, the turnover is recognized on March 5, because that’s the earliest event.

This approach ensures that your VAT reporting reflects the actual timing of transactions, helping you stay compliant with Federal Tax Authority (FTA) requirements.

One important thing to mention is that you’ve probably noticed that in turnover, we’ve included imports, which might look odd. However, according to the regulation, if a company imports goods worth more than AED 375,000, it must register for VAT. However, as of the article’s publication date, we note that FTA disallows inclusion of imports (or other taxable expenses) when calculating turnover, relying solely on taxable supplies.

When do I have to apply for VAT registration, and how long would it take?

The VAT registration requirements are very clear. According to UAE tax laws, you must send in your application no later than 30 days after you become legally required to do so. In theory, it takes approximately 60-90 minutes to complete the online application, and the FTA processes your submission within 20 working days. However, in reality, it may take significantly longer due to incomplete documentation, missing data, and, consequently, queries from the Federal Tax Authority.

List of documents required for VAT registration in UAE

To obtain approval from the Federal Tax Authority quickly, you must carefully prepare the documents for VAT registration. This is very important because, in our experience, incorrect or incomplete paperwork is one of the biggest reasons for delays or rejections.

Required documents for VAT registration application (filled online on the FTA website)

Here is a checklist of the core documents required for VAT registration:

- A valid trade license, along with branch licenses (if any)

- Official declaration letter stating the total taxable supplies and monthly sales from the date of establishment until the date of application, stamped and signed by the authorized signatory

- At least 3 sales tax invoices signed and stamped

- Documents confirming expected revenue (optional)

- Contact information, such as e-mail, mobile number, and office address (if any)

Additional documents for VAT registration

Here is an extra checklist of supplemental documents, based on business classification:

| Classification | Documents Needed |

|---|---|

| For All Legal Entities | ● Certificate of Incorporation ● Memorandum of Association / Articles of Association/Partnership Agreement ● Emirates IDs for all Owners and Authorized Signatories ● Passport copies for all Owners and Authorized Signatories ● Power of attorney document for the Authorized Signatory, required if the Authorized Signatory is not mentioned in the Memorandum of Association. ● Bank letter detailing the business’s bank account information (optional) |

| For Government Entities | Copy of the Establishing Decree |

| For Individuals | ● Emirates ID and passport copy ● Customs information (if available) ● Bank letter |

| For Clubs/Charities/Associations | Registration documents and supporting evidence |

Before submitting, ensure each scanned document (PDF or DOC) is under 15 MB and has clear text.

Source: FTA VAT registration requirements

Step-by-step guide: how to register for VAT?

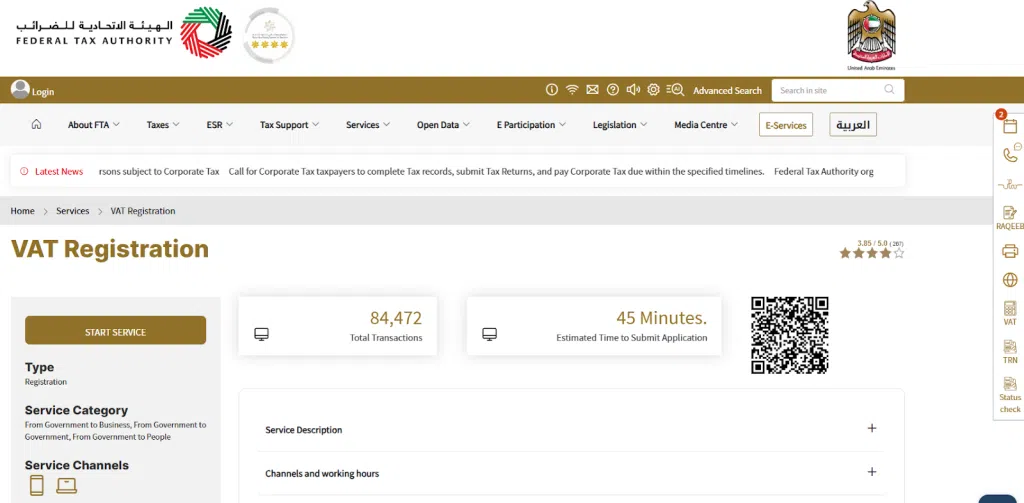

Here is a step-by-step guide to help you register for VAT on the EmaraTax portal:

- Create an EmaraTax Account

Go to the FTA website and create an account. You can use UAE Pass to log in. - Create a Taxable Person Profile

After logging in, you must create a new “Taxable Person” profile. This is done by entering the mandatory details for your business entity. - Initiate Online VAT Registration

To begin the formal VAT registration process, click the “Registration” button on the VAT tab in your Taxable Person dashboard. - Complete the Multi-Section Application

Fill out all mandatory fields in each sequential section of the VAT registration form, starting with Entity Details and Identification Details. Then, you’ll be asked to supply Eligibility Details, Contact Details, Business Relationships, Bank Details (bank account details are optional but recommended), Additional Details, and Authorized Signatory information. - Review, Declare, and Submit

Double-check the data you supplied in the final section of the VAT registration. Then, click “Submit” to send the paperwork for consideration. Save your application reference number. - Await Decision

Keep an eye on your dashboard regularly – the FTA can request further information before the final decision regarding your VAT certificate. Based on our past experience, the average timeframe is 2-3 working weeks. - Get your VAT Certificate and Tax Registration Number (TRN)

A TRN is required to file VAT returns and ensure legal compliance with FTA.

Registration assistance

If you need visual guidance to figure out how to register for VAT, you can refer to the helpful e-learning video provided by FTA. Also, all questions regarding the VAT in the UAE (how to pay VAT, how to file VAT returns, how to claim input tax credits, etc.) can be addressed to Tara, FTA’s AI assistant.

Common mistakes to avoid during UAE VAT registration

Here is a table with frequent VAT registration mistakes, their consequences, and tips to prevent them:

| Common mistake | Consequences | How to avoid |

|---|---|---|

| Incomplete paperwork | Rejection or application cannot proceed | Always check the FTA VAT Registration checklist before applying |

| Incorrect file formats or oversize files | Uploads rejected; application cannot proceed | Submit PDF or DOC only; Use online tools for compressing files if needed |

| Data inconsistency | Queries from FTA or application rejection | Use documents with up-to-date information; Double-check the application before submission |

| Missing the 30-days registration deadline | Penalty of AED 10,000 | Track your rolling 12-month turnover against the mandatory registration threshold of AED 375,000 weekly; Set up calendar reminders before the deadline |

skrooge.ai: Who are we, and how can we help you?

We are a next-generation accounting company — run by finance professionals and Skrooge, the clever AI CFO. Our team delivers precision, insight, and strategic guidance while AI automates the processes to make them scalable, consistent, quick and cost-effective. Our mission is straightforward: we save your budget, save your time, and handle your finances in a clear, convenient, and tax-compliant manner.

How can we help you with VAT registration and further compliance?

Applying for VAT registration can be overwhelming, as it involves tracking taxable supplies and imports, collecting documents, completing forms, and managing deadlines alongside business growth. That’s where skrooge.ai comes in. With us, the process will be smooth because we’ll track deadlines and ensure all documents are prepared and consistent. After the registration part, we will, of course, cover the regular quarterly VAT filing, which is a separate story.

- No more rejected applications. We handle your registration process end-to-end.

- No more missed thresholds. We constantly monitor your rolling 12-month turnover and inform you when it’s time to register for VAT.

- No more skipped deadlines. Automated reminders help you stay on schedule, preventing penalties.

- No more worries about future tax compliance. We cover your accounting — managing your periodic VAT returns and ongoing bookkeeping to ensure your VAT is accurate and on time.

This material is for informational purposes only and does not constitute legal or tax advice.

FAQ

Essential documents include the certificate of incorporation, active company trade license, MoA/AoA, and passports/EIDs of the owners and authorized signatories. Additional documents and financial records may be required based on your business type/activities.

In theory, VAT registration UAE takes around 60-90 minutes to finish the online application, and the FTA takes up to 20 working days to process your submission. However, the process could take much longer due to missing documents and application errors. That’s why we recommend contacting professionals for tax registration.

It is mandatory only in case your taxable supplies and imports exceed the mandatory registration threshold of AED 375,000 in the past 12 months or are expected to do so in the next 30 days. For businesses below this level, but with an annual turnover exceeding the voluntary registration threshold of AED 187,500, registration in the UAE is elective.

Once your business receives its VAT Registration Number, you officially become a VAT-registered business and must start charging VAT on taxable supplies (see the article body for details on what this means). From this point, you can also claim input tax credits on your taxable expenses — meaning the VAT you pay on business purchases can be deducted from the VAT you collect from customers.

Yes, you can register for VAT online. The entire process of VAT registration in the UAE is conducted online via the FTA portal. To begin, sign up for an EmaraTax account. Then, complete the application and attach any necessary digital documents for registration in the UAE. If you have any questions on how to register for VAT — book a call with us.

Mandatory registration is required by law when your annual turnover exceeds AED 375,000. Voluntary registration is an option for businesses exceeding the voluntary registration threshold of AED 187,500.

Failing to register for VAT if you meet mandatory registration criteria before the due date can result in a penalty of AED 10,000.

Usually, yes, if the authorized signatory or the owner is a UAE resident. If no one on the application is a UAE resident, you can proceed with passport copies instead.

Absolutely. skrooge.ai‘s team of experts, with multiple years of experience and backed by software/AI, handles the entire process. Whether you need VAT registration in Dubai, voluntary registration, assistance with financial documents, consultation on VAT laws, or any other related service, you can expect accuracy, speed, and full compliance.

A TRN is a unique tax registration number issued by the FTA upon successful VAT registration for a new company. You get it by completing the online application on the EmaraTax portal, after which it will appear in your dashboard.

Yes, Value Added Tax is an indirect tax. It is levied on the sale of goods and services, so it’s the end consumers who pay VAT. Businesses, on the other hand, charge VAT and remit it to the government on behalf of the tax authority.

No, the Federal Tax Authority does not charge any fee for VAT registration services, regardless of whether it’s a tax group, a legal person, or a sole establishment.

Thank you!

We've received your request and will get back to you shortly.