- Connect & Onboard

Link your accounting systems, bank feeds, and install the Gmail plugin - Automated Document Capture

Send invoices, receipts and bills via the Gmail plugin or direct upload

- Connect & Onboard

Link your accounting systems, bank feeds, and install the Gmail plugin - Automated Document Capture

Send invoices, receipts and bills via the Gmail plugin or direct upload

- Connect & Onboard

Link your accounting systems, bank feeds, and install the Gmail plugin - Automated Document Capture

Send invoices, receipts and bills via the Gmail plugin or direct upload

In the middle of every difficulty lies opportunity.

— Albert Einstein

- SMEs in UAE (2024): 557,000

- Average spend on accounting services per SME: AED 15,000/year

- Estimated market size: AED 8.3 billion annually

- SMEs in UAE (2024): 557,000

- Average spend on accounting services per SME: AED 15,000/year

- Estimated market size: AED 8.3 billion annually

- Estimated market size: AED 8.3 billion annually

- SMEs in UAE (2024): 557,000

- SMEs in UAE (2024): 557,000

- Average spend on accounting services per SME: AED 15,000/year

- Estimated market size: AED 8.3 billion annually

- SMEs in UAE (2024): 557,000

- Average spend on accounting services per SME: AED 15,000/year

- Estimated market size: AED 8.3 billion annually

- Estimated market size: AED 8.3 billion annually

- Estimated market size: AED 8.3 billion annually

- SMEs in UAE (2024): 557,000

If you’re doing business in the UAE, you probably already heard something about the importance of Corporate Tax registration and the hard-hitting fines for missing the deadline. The Federal Tax Authority (FTA) has made it official: every business, from small startups in Dubai to companies operating in free zones, needs to register. It’s not just another formality — missing it could get you a AED 10,000 fine, and that’s before we even talk about the headaches of being non-compliant.

So what exactly needs to be done, and when? That’s what this guide is here for. We’ll go through the essentials — who needs to register, the FTA deadlines, which documents you’ll need, and how the whole process works inside the EmaraTax portal.

The goal is simple: help you stay compliant without getting lost in bureaucracy. By the end, you’ll know exactly how to register for UAE corporate tax — and you can get back to running your business instead of worrying about penalties.

What is UAE Corporate Tax

Back in 2022, the UAE introduced a new federal uae corporate tax law – registration is now required under Federal Decree-Law No. 47. This applies to both mainland companies and those operating in free zone businesses.

So, if your business earns more than AED 375,000 in taxable income during the corporate tax period, you’ll be taxed at 9%.

But there’s a catch – Small Business Relief: UAE-resident taxpayers with revenue not exceeding AED 3 million can elect a 0% corporate tax outcome for periods ending on or before 31 December 2026. This relief does not apply to Qualifying Free Zone Persons or large MNE groups.

Who Needs to Register for Corporate Tax UAE

In the UAE, the Federal Tax Authority (FTA) requires every taxable person to register for corporate tax — even if your business doesn’t expect to pay any tax or is fully exempt. The idea is simple: the FTA wants every business to be officially on the radar so that tax reporting and compliance run smoothly.

Businesses and individuals required to register:

- Mainland companies: Any business with a valid trade license falls under this rule. That includes LLCs, partnerships, and even sole establishments earning over AED 1 million in annual revenue.Free zone entities: Registration is still compulsory, even if your company qualifies as a Qualifying Free Zone Person (QFZP) and enjoys the 0% corporate tax rate. You can’t skip this step just because you’re tax-exempt.Foreign companies: If your business is based outside the UAE but operates here – say, through a local office, warehouse, or an agent who regularly conducts business on your behalf – it’s considered to have a Permanent Establishment (PE). That means you also need to register.Individuals (natural persons): Freelancers, consultants, and self-employed professionals who earn above the taxable income threshold must register too, as long as their work counts as a commercial or professional activity under UAE law.

So, is corporate tax registration mandatory in UAE? Yes. Every business, even those with low or exempt income, must register for for corporate tax to stay compliant.

Exempt persons: Some entities do not need to register for corporate tax UAE, such as:

- government controlled entities

- investment funds, or those benefiting from private pension exemptions.However, exemptions are subject to conditions, and all legal persons should carefully assess their status with the help of a tax advisor.

Now, here’s something a lot of people miss when dealing with UAE corporate tax law:

even if your company qualifies for a 0% tax rate – like a small business under the Small Business Relief scheme or a free zone setup – you still have to register if you do not fall under the exception.

The FTA wants every business on the books to keep things transparent and in line with the rules. Ignoring the corporate tax UAE registration last date could result in penalties.

Corporate Tax Registration Deadlines and Penalties

The UAE corporate tax registration deadline depends on the date of your business license information issuance. Missing the deadline leads to an administrative penalty of AED 10,000.

Corporate Tax Deadlines UAE 2025

The corporate tax UAE registration deadline depends on the date of your business license issuance.

| License Issue Date | Registration Deadline |

Before 1 March 2024 | By 31 May 2024 |

From 1 April 2024 | Within 3 months of license issue |

| Header 1 | Header 2 |

|---|---|

| Content 1 | Content 2 |

| Content 1 | Content 2 |

Failing to meet tax registration deadline UAE will also affect the ability to file returns on time, increasing compliance risks.

Required Documents for UAE Business

To complete the UAE corporate tax registration process, businesses must prepare specific paperwork. The documents required for corporate tax registration in UAE are as follows:

- Trade license copy

- Passport and Emirates ID of owners/partners

- MOA (if aplicable)

- Certificate of Incorporation (if aplicable )

- Business activities description

- Authorized signatory details such as Emirates ID, passport, e-mail and phone number

- Contact information and registered address

Tip: Collect all tax registration documents in advance to avoid delays. Keeping the documents required for corporate tax registration ready before the corporate tax registration UAE deadline ensures a smoother process.

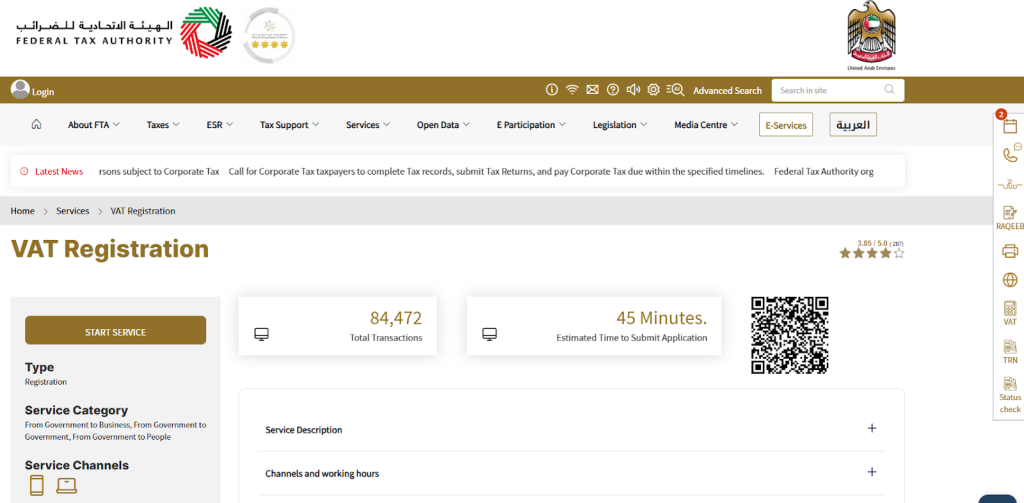

Step-by-Step Corporate Tax Registration Process via EmaraTax

If you’re handling your setup in the UAE, chances are you’ll be doing it through EmaraTax – the official Federal Tax Authority platform. It’s the same system used for VAT and excise tax, and now it covers tax registration UAE too.

How to Register for Corporate Tax in UAE

Below are the key steps you’ll likely need to complete to register for corporate tax in or UAE.

- Create an EmaraTax account

Visit the Federal Tax Authority website and access the EmaraTax portal.

Sign up using your company details, email address, and mobile number.

Assign an authorized signatory, who will be responsible for submitting tax-related forms.

- Visit the Federal Tax Authority website and access the EmaraTax portal.

- Sign up using your company details, email address, and mobile number.

- Assign an authorized signatory, who will be responsible for submitting tax-related forms.

- Log in and select “Corporate Tax Registration”

After account activation, log in to your UAE corporate tax dashboard.

Choose the Corporate Tax option under services.

- After account activation, log in to your UAE corporate tax dashboard.

- Choose the Corporate Tax option under services.

- Complete the corporate tax registration application form.

Add your company’s main details – trade license number, type of legal entity (like LLC or PJSC), and a brief overview of what your business does.

List owner details and the authorized signatory – the person legally allowed to sign and act on behalf of the company.

- Add your company’s main details – trade license number, type of legal entity (like LLC or PJSC), and a brief overview of what your business does.

- List owner details and the authorized signatory – the person legally allowed to sign and act on behalf of the company.

- Upload required documents

These include: trade license, Emirates ID, passport copies of owners/partners, and proof of business activities.

Make sure everything’s current and the scans are clear. Blurry images or expired documents are one of the most common reasons applications get kicked back, so it’s worth double-checking before you upload.

- These include: trade license, Emirates ID, passport copies of owners/partners, and proof of business activities.

- Make sure everything’s current and the scans are clear. Blurry images or expired documents are one of the most common reasons applications get kicked back, so it’s worth double-checking before you upload.

- Submit the application and receive an acknowledgment

After verifying all information, submit the form.

You will receive a reference number to track your application status.

- After verifying all information, submit the form.

- You will receive a reference number to track your application status.

- Track your application status

The EmaraTax dashboard allows you to monitor the progress of your application in real time.

If the FTA requires clarifications or additional documents, you will be notified directly through the portal.

- The EmaraTax dashboard allows you to monitor the progress of your application in real time.

- If the FTA requires clarifications or additional documents, you will be notified directly through the portal.

- Receive your Tax Registration Number (TRN)

Once approved, the FTA issues a Corporate Tax Registration Number (TRN).

This number confirms that your business is registered and must be used for all future filings and communications with the FTA.

- Once approved, the FTA issues a Corporate Tax Registration Number (TRN).

- This number confirms that your business is registered and must be used for all future filings and communications with the FTA.

The process usually takes 2–3 weeks. But small mistakes can slow corporate tax registration process down, so it’s worth double-checking before you hit submit. Many businesses choose to hire a tax advisor for smoother UAE corporate tax submissions.

Common Mistakes to Avoid During Registration

Many businesses face penalties and other difficulties when dealing with UAE corporation tax. The FTA has clear rules, but overlooking details can delay approval or trigger fines. Below are the most frequent registration mistakes, their consequences, and tips how to avoid them:

Mistake | Consequences | How to Avoid |

|---|---|---|

Using the wrong legal entity type | Application rejection or significant delay in approval. | Always check your trade license to ensure the correct legal entity (e.g., LLC, sole establishment, or partnership) is selected before submission. |

Missing the registration deadline | Immediate AED 10,000 penalty and potential non-compliance with FTA regulations. | Monitor your UAE corporate tax deadlines closely based on your license issue date, and submit well before the corporate tax registration deadline UAE. |

Uploading incomplete or unclear documents | Application may be put on hold or rejected, requiring re-submission. | Prepare all required documents in advance and ensure scans are clear, complete, and valid. |

Failing to authorize the correct signatory | Rejection of the registration application and need for re-authorization. | Confirm that the authorized signatory listed in your trade license or company records matches the one submitting the form. |

Ignoring compliance updates from the FTA | Missed changes to requirements or filing obligations, leading to possible fines or non-compliance. | Regularly review FTA updates or work with a professional to ensure ongoing compliance with corporation tax laws. |

The takeaway: registration mistakes are avoidable with thorough preparation. Always verify details—the last date to register for corporate tax in UAE is strictly enforced, and fixing errors later is both costly and time-consuming.

Corporate Tax Compliance After Registration

Registration is just the first step. Companies must meet ongoing tax obligations to remain compliant:

- File annual returns via EmaraTax within 9 months of the end of the financial year

- Maintain accounting records for at least 7 years

- Notify FTA of changes in ownership, license, or activities and update on portal within 20 days

- Make timely tax payments

Filing timelines are based on the relevant tax period, and obligations differ depending on the company’s financial year. Just as the corporate tax registration deadline 2023 set a strict precedent for timely registration, ongoing compliance deadlines are equally important.

How Skrooge Can Help with Your Registration

Navigating UAE corporate tax law can be complex. At Skrooge, we combine AI with experienced accountants to simplify the process.

Our services include:

- Expert support with FTA compliance

- Avoiding mistakes that lead to penalties

- Filing corporate tax returns on your behalf

- Affordable corporate tax services starting at AED 499

Contact Skrooge today to ensure your business stays compliant with the tax authority and avoids penalties.

Conclusion

Registering for corporate tax in the UAE isn’t optional – it’s a legal requirement that keeps your business compliant and protected. Whether you’re handling corporate tax in Dubai or anywhere across the UAE, meeting the UAE corporate tax registration last date is essential to avoid penalties and stay on track. If you’d rather not deal with deadlines and forms, Skrooge can handle the entire corporate tax registration UAE process for you – from paperwork to ongoing compliance – so you can stay focused on growing your business.

FAQ on Tax Registration in UAE

Let’s look at some of the most common questions our readers ask.

What is the deadline for corporate tax registration in UAE?

Deadlines depend on your license issue date. Generally, businesses must register within 3 months of issuance. Missing deadlines may result in an AED 10,000 penalty. The last date of corporate tax registration in UAE is strictly enforced, so make sure you know your own corporate tax registration last date.

Is registration for corporate tax mandatory for all businesses in UAE?

If you’re wondering who should register for corporate tax in UAE – In general, all the businesses – mainland, free zone, and foreign with a PE – must register, even if they qualify for a 0% rate or relief. But there are some exceptions: government controlled entities and investment funds.

What documents are required for corporate tax registration?

Key documents required for corporate tax registration in UAE include trade license, Emirates ID, passport copies, business activity details, and financial information. Preparing all corporate tax registration requirements in advance helps avoid delays.

How long does the corporate tax registration process take?

Registration timeline typically takes up to 20 working days via the EmaraTax portal. For businesses in the UAE, the corporate tax registration process is handled online through the same system.

What is the penalty for late tax registration?

The FTA imposes an AED 10,000 fine for late registration. You must apply for the VAT registration within 30 days after your annual turnover hits AED 375,000 threshold. Missing the deadline for corporate tax registration or the last date for corporate tax registration may also affect the ability to file returns on time.

Can I register for corporate tax myself or do I need professional help?

You can register independently via EmaraTax, but professional support helps avoid errors and delays.

Do free zone companies need to register for corporate tax?

Yes, all free zone entities must register, though some may benefit from 0% tax. Corporate tax registration for freezone company is mandatory, even if you ultimately qualify for tax relief.

What is EmaraTax and how do I access it?

EmaraTax is the official online portal of the FTA. You can access it through the FTA website.

What happens after I submit my tax registration?

The FTA reviews your application, issues a TRN if approved, and enables filing obligations.

How much does corporate tax registration UAE cost?

Registration itself is free. Skrooge offers expert tax filing services starting at AED 499.

How satisfied are you with the Content Editor?

Terrible

Bad

Ok

Thank you!

We've received your request and will get back to you shortly.