What is a tax invoice in the UAE?

A tax invoice is a document that VAT-registered businesses must issue for any taxable supply to recognize a revenue transaction. A tax invoice should be issued by the seller to the buyer within 14 days of the date of supply. The copy of the invoice must be stored for audit purposes:

- for 5 years in general

- for 15 years, in case of transactions related to real estate

In the UAE, companies most often exchange electronic invoices in PDF format. However, in 2026, e-invoicing is expected to be introduced in the UAE, which should help standardize the tax invoice format.

Why is it important to store properly formatted tax invoices?

These tax invoice records serve as the basis of the financial documentation for your company and ensure tax compliance with UAE VAT regulations:

- When properly issued to your buyers, they help you avoid a 2,500 AED administrative fine for each case of an unissued or incorrectly formatted tax invoice

- Once received from your suppliers, they serve as proof of the purchase transaction to claim input VAT

Even if your business is not VAT-registered yet, it’s important to store properly formatted tax invoices for the purchase transactions, because:

- You can still use them after registering to claim input VAT. Purchases of services can be claimed within a 5-year period from the date of purchase, while goods can be claimed for their unused portion. For example, for capital assets, this would be the non-depreciated portion.

- VAT-compliant tax invoices also ensure that your expenses will be deductible for corporate tax (CT) purposes as well. More on that point below

CT-compliant purchase invoices

Although CT regulation doesn’t strictly define the required invoice fields (unlike VAT), you must still keep adequate records to substantiate income/expenses and file correctly; the record-keeping period is 7 years after the end of the relevant Tax Period.

So, in our practice, we rigorously check that the following fields are listed on the invoices that our clients receive, so that their expenses are deductible for CT purposes:

| Field | Requirement |

|---|---|

| Issuing company name | Must be valid and verifiable via FTA |

| Recipient name | Must match your registered business details |

| Invoice date | Must reflect the actual transaction date |

| Unique invoice number | Enables traceability and record tracking |

| Description of goods or services | Must be specific and clear, not generic |

| Currency and amount | Used to calculate the taxable base |

What if the purchase invoice doesn’t contain one of the fields above?

You might lose on two fronts:

- The expense will not be recognized for CT deduction (9% of the purchase amount) because the transaction records are not sufficient

- You will not be able to claim input VAT (5% of the purchase amount) because these fields are required for VAT compliance of the invoice as well. As you will see in the next section, VAT invoice standards in the UAE are stricter than those for CT and require more fields to be present in the invoice

So, overall, you could effectively overpay up to 14% of the purchase amount. At skrooge.ai, we ensure that on both fronts your invoices remain compliant, deductible, and penalty-free.

VAT invoice format: full tax invoice vs simplified invoice

There are two types of VAT invoice formats: full tax invoice and simplified tax invoice. Let’s take a closer look at them.

A full (standard) tax invoice is a detailed document that a seller issues to a buyer for a taxable supply to recognize a revenue transaction. You must issue a full tax invoice if at least one of the following FTA conditions is met:

- The recipient is VAT-registered.

- The amount of the supplies exceeds AED 10,000.

So, it is typically used for B2B transactions.

A simplified tax invoice is a streamlined version of a full (standard) tax invoice. It is often issued by retail companies involved in B2C transactions. For example, any receipt from a grocery store is a simplified tax invoice. You can use it in the following cases:

- Transactions valued at AED 10,000 or less

- Sales to customers who are not VAT-registered

It must be issued on the same day as the sale or service occurs. As you can probably guess from the names, the requirements for a full tax invoice are higher (more fields are required) compared to the simplified tax invoice.

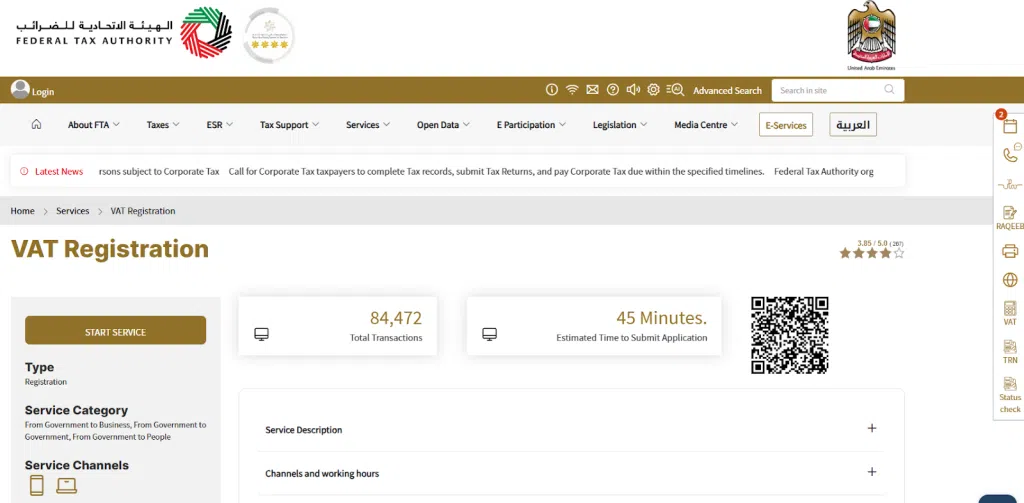

Federal Tax Authority (FTA) requirements for a full (standard) tax invoice

- The words “Tax Invoice” clearly displayed on the invoice

- Issuing company (supplier) name with address and Tax Registration Number

- Recipient company (customer) name with address and Tax Registration Number

- Unique invoice number

- The issue date

- The date of supply, if different from the date of issuing the tax invoice

- A description of the goods or services supplied

- For each good or service: the unit price, the quantity or volume supplied, the rate of tax, and the amount payable in AED

- The amount of any discount offered

- The gross amount payable in AED

- The VAT amount charged in AED

- Exchange rate, if applicable

If you’re having trouble drafting a document, you can download our full tax invoice template (in the relevant section below). We also attach the tax invoice template for foreign currency (FX) transactions, which emphasizes the importance of displaying the exchange rate, gross amount, and tax amount in AED, in addition to the FX amounts.

FTA requirements for a simplified tax invoice

It shall contain all of the following particulars according to Federal Tax Authority Requirements:

- The words “Tax Invoice” are clearly displayed on the invoice

- The name, address, and TRN of the registrant making the supply

- The issue date

- A description of the goods or services supplied

- The gross amount payable and the VAT amount charged in AED

Comparison Table: simplified tax invoice format vs full tax invoice

Let’s take a look at the differences between the different tax invoice formats:

| Field | Full tax invoice | Simplified tax invoice |

|---|---|---|

| “Tax invoice” clearly displayed | Yes | Yes |

| Supplier name with address and TRN | Yes | Yes |

| Invoice date | Yes | Yes |

| Description of goods and services | Yes | Yes |

| Gross amount payable & VAT amount (AED) | Yes | Yes |

| Recipient company (customer) name with address and TRN | Yes | — |

| Invoice number | Yes | — |

| Supply date | Yes | — |

| For each good or service: unit price, quantity, taxable amount, VAT rate and amount, amount payable in AED | Yes | — |

| Exchange rate (if FX transaction) | Yes | — |

How to calculate VAT?

Here is a good example of how to calculate VAT.

For the supply of goods/services for AED 20,000 at a 5% VAT rate:

- Net amount: AED 20,000

- Discount applied (10% rate): AED 2,000

- VAT amount (5% rate): AED 1,000 = 18,000 * 5%

- Gross amount: AED 21,000.

An important nuance is that VAT is added after the discount is applied. However, we don’t anticipate any issues with these calculations, as all accounting software packages are designed to do it correctly.

Common mistakes and penalties

Non-compliance with FTA tax invoice requirements may result in large fines. Let’s break down the most common mistakes, what they can cost you, and how to avoid them.

Table with the most common FTA violations and penalties

| Violation | Penalty | How to avoid |

|---|---|---|

| Incorrectly issued or unissued tax invoice | AED 2,500 fine for each detected case | Use up-to-date templates when issuing invoices; Check FTA requirements regularly |

| Wrong VAT filing (due to incorrect purchase tax invoices leading to inadmissible VAT) – if mistake is uncovered during the FTA audit | 50% of the unpaid tax amount plus 4% penalty per month | Check the compliance of the invoices issued by your vendors |

| Wrong VAT filing – if mistake is reported by the company | 5% of the unpaid tax (increases to 40% if filed in 4 years) amount plus 4% penalty per month | Check the compliance of the invoices issued by your vendors |

Source: Administrative Penalties for Violation of Tax Laws in the UAE

Who is Skrooge, and how can he help you with tax invoice compliance?

Skrooge is an AI accountant backed by a team of professional financiers and accountants. Basically, he’s an AI CFO who sorts, reconciles, files, and reminds without mistakes or breaks.

The advantage of using Skrooge to ensure tax invoice compliance is that he can handle any volume of invoices for any number of clients at a speed not achievable by human accountants. That’s why our team is focused on more strategic tasks, such as designing custom charts of accounts or providing complex tax advisory services for our clients.

Useful templates

Our team of professional accountants has prepared user-friendly tax invoice templates that meet the Federal Tax Authority requirements.

- Download Template for Standard Tax Invoice (AED transaction)

- Download Template for Standard Tax Invoice (FX transaction)

- Download Template for Simplified Invoice

Offering layout can be tailored with your:

- Company logo

- Business information

- Customer details

- Itemized lists

- Tax calculations

What else can skrooge.ai help you with?

skrooge.ai delivers end-to-end accounting & tax services across all UAE jurisdictions, combining expert accountants with AI-powered software, and can help you with:

- Bookkeeping & Accounting

No more missing invoices, just precise, audit-ready numbers - Financial Reports & Dashboards

Your P&L, Cash Flow, and Balance Sheet, always clear, always up to date - Corporate Tax & VAT Filing

Deadlines handled, fines avoided, ensure compliance on autopilot - Tax Advisory

Practical, business-first guidance that cuts your bill and your stress

FAQ: Tax Invoice Format UAE

The essential details for the compliant VAT invoice format are the words “Tax invoice” clearly displayed; supplier name with address and TRN; customer name with address and TRN; invoice number; the invoice date; the date of supply; the description of goods/services provided; for each good or service: unit price, quantity, VAT rate, VAT amount, the amount payable in AED; discounts (if any); gross amount payable in AED; total VAT amount in AED; exchange rate if applicable.

Penalties begin at AED 2,500 for missing details on issued tax invoices. There is also a variable penalty (5% or 50%, depending on who discovers the mistake—you or FTA) applied to the unpaid VAT amount due to non-compliant purchase tax invoices. For each month that this amount remains unpaid, an additional 4% penalty will be added.

Yes, skrooge.ai offers a free template that meets all the Federal Tax Authority requirements.

When issuing tax invoices in a currency other than AED, you are required to convert the taxable amount and the VAT amount into dirhams using the official exchange rate applied as published by the UAE Central Bank on the exact date of supply. The exchange rate must be clearly displayed on the invoice.

A VAT Return is the periodic summary you file with the FTA showing total VAT due or refundable for the period, whereas a tax invoice serves as the legal proof for each taxable supply and the VAT charged.

In the UAE, tax invoices must be stored for a minimum of 5 years and a maximum of 15 years for real estate records. If a company fails to keep its tax invoices, the Federal Tax Authority (FTA) may impose administrative penalties and disallow input VAT recovery, which can increase the business’s overall tax liability.

To calculate VAT in the UAE, multiply the taxable amount (the value of goods or services) by the applicable VAT rate, currently 5%. For example, if the taxable value is AED 1,000, VAT = 1,000 × 5% = AED 50. The total invoice amount payable would then be AED 1,050.

Yes, handwritten tax invoices are legally allowed in the UAE as long as they contain all the mandatory details required by the FTA such as TRN, invoice date, description of goods/services, VAT amount, and total payable. However, most businesses use electronic invoicing systems because they reduce errors and make compliance easier.

This material is for informational purposes only and does not constitute legal or tax advice.